Megan Langford

We will attempt to predict

future values for stamp prices in the United States by analyzing the historical

behavior of the prices over time.

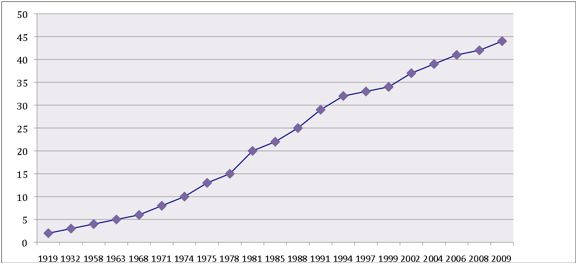

Here is a graphical display

for the actual stamp prices in the United States over its history.

Now we will apply several

different types of functions to see which one best represents the behavior of

the data.

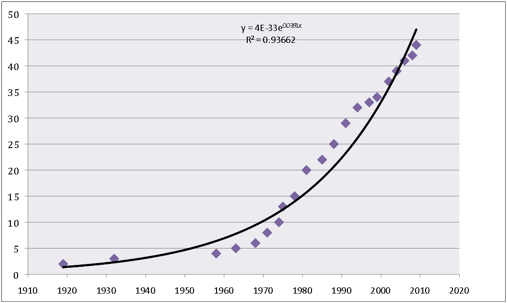

First, by using an

exponential function to best explain the shape of the data, we get the

following graph:

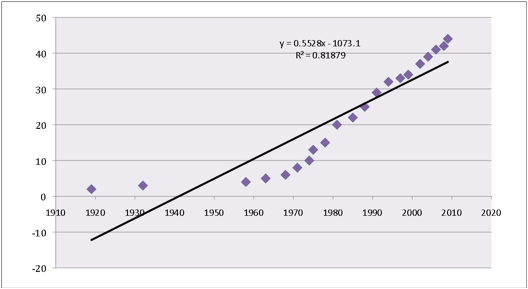

Next, by using a linear

function to best explain the shape of the data, we get the following graph:

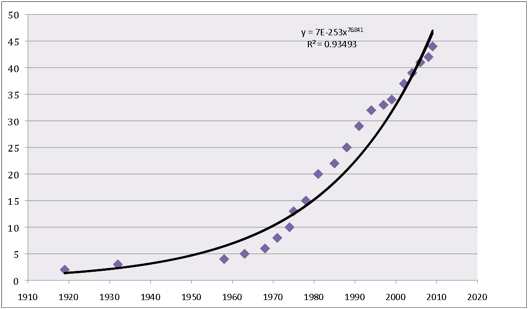

Finally, by using a power

function to best explain the shape of the data, we get the following graph:

Notice that for each of our

graphs, the equation for the trend line is shown above the data in y= format.

The ![]() value

rates the predictability strength of the function for the data set. For regression analysis purposes, the

value

rates the predictability strength of the function for the data set. For regression analysis purposes, the ![]() value

closest to 1 indicates which function most closely relays the data

behavior.

value

closest to 1 indicates which function most closely relays the data

behavior.

Although all three function

types appear closely related to the data, the ![]() value

closest to 1 is the one for the exponential function. We can also see it is very close to the data set because the

data points all fall very close to the graph of the function.

value

closest to 1 is the one for the exponential function. We can also see it is very close to the data set because the

data points all fall very close to the graph of the function.

We now know which method

will best predict the values of stamp prices for years to come. Now letŐs expand our data table using

the exponential function created to best fit the data in order to predict

future stamp prices.

Year Stamp

Price (cents)

|

2006 |

41 |

|

2008 |

42 |

|

2009 |

44 |

|

|

|

|

2010 |

48.8503725 |

|

|

|

|

2017 |

64.21871262 |

|

2018 |

66.77780289 |

|

2019 |

69.43887189 |

|

|

|

|

2028 |

98.70460924 |

|

2029 |

102.6379488 |

|

2039 |

151.7096729 |

|

2049 |

224.2428372 |

We can now see that we can

expect the price to rise more than 3 cents (actually, close to 5 cents) in the

next year. The price should reach

64 cents by 2017, and $1 by 2029.

So will this function be

accurate for predicting stamp prices for any year we ask it to?

First, letŐs attempt to

obtain an expected stamp price for a year prior to the start of the data

set. When we input the year 1800,

the function gives us an expected stamp price of about a hundredth of a

cent. In reality, U.S. stamps were

not created until 1847.

Taking a look 100 years from

now, our function predicts the stamp price will reach $23.38 by 2109. Even with a high rate of inflation from

now until then, this seems rather unlikely. In perspective, this means that stamp prices have increased

from 2 cents to 44 cents over the last 100 years, and they will rise from 44

cents all the way to $23.38 over the next 100 years.

The lesson to learn from

this exercise is that although our function is extremely useful for the years

relatively near our data set, the variables may have very different behavior as

we get further away from our known data set. In reality, this is true for most methods of creating best

fit lines.